By Stephen Bowers

Product Demand and Disposition

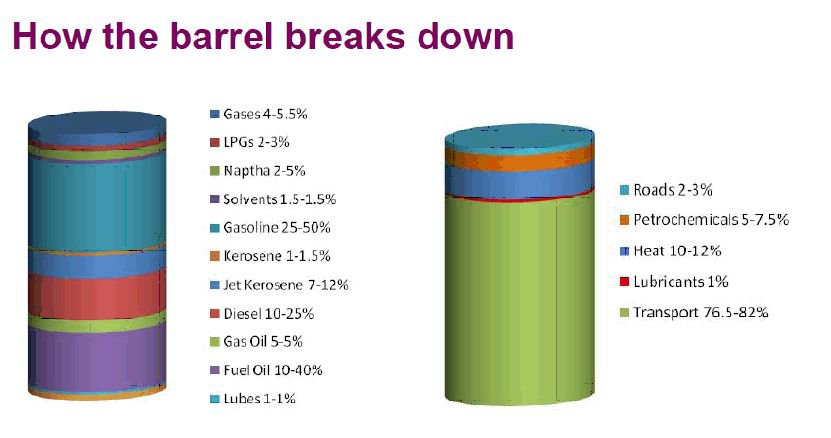

It is worth looking at the typical disposition of the products from a barrel of oil and Chris Skrebowski's (of Peak Oil Consulting) slide Fig. 1 does it well.

Fig. 1 - Source: Skrebowski Energy Institute Oil Depletion Conference 2008

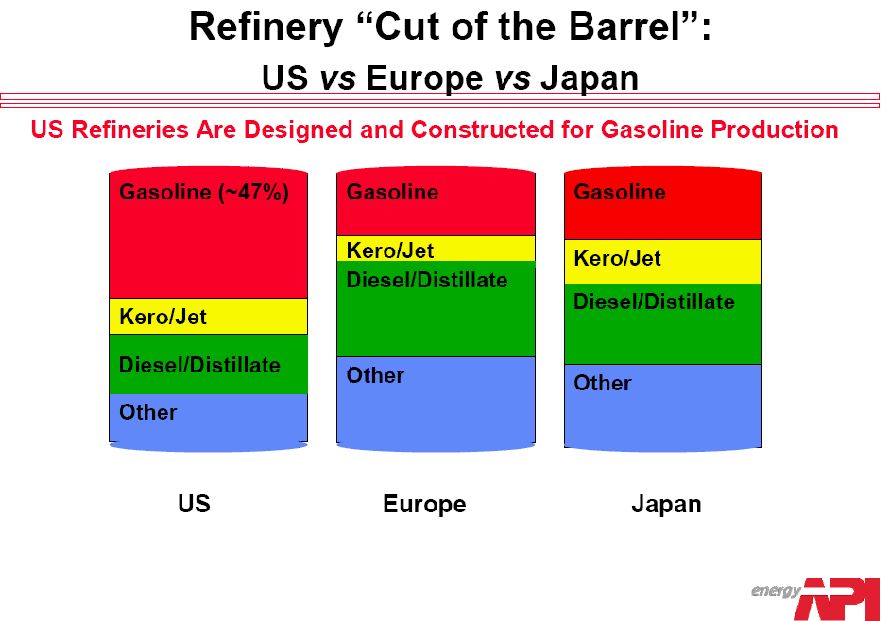

By far, the majority of crude oil is consumed in the production of transport fuels. On a regional basis there are significant differences with Europe emerging as a middle distillate market and the US remaining firmly in the gasoline mode. (See Fig. 2.)

Fig. 2 - Source: Jim Williams 2007 American Petroleum Institute Diesel Fuel, Use, Manufacturing and Supply

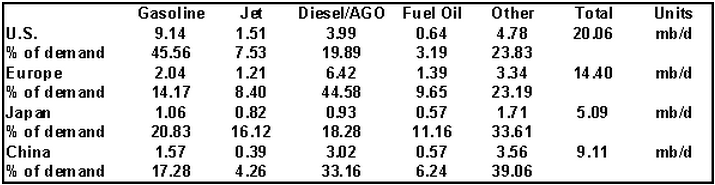

It is worth noting the difference in product demand because this significantly affects the configuration of a refinery. As can be seen, the US demand is focused on gasoline and in Europe the desired products are jet kerosene and diesel. In the US there is considerable capacity to convert middle distillate to gasoline. Converting light products to middle distillate is much harder and there are few processes available. In terms of fuels specifications it is apparent that the EU EN 228 and EN 590 fuel specifications for gasoline and diesel respectively are emerging as the dominant specifications as they are being widely adopted in the developing countries. Europe has been a leader in small diesel engine capability (Mercedes, BMW, Audi VW, Peugeot, Fiat), even ahead of the Japanese, and within Europe more than 50% of new cars sold are now diesel. Even the premium luxury brands now have diesel options. This is driven by the fuel economy as measured in volumetric terms and by taxation. Table 1 below is constructed from the Feb 2011 IEA Oil Market Report and gives the % of demand for each product group (note - 1 month's data should not be taken in isolation). Notice how the US has managed to reduce fuel oil production. The real point though is the sheer difference between gasoline and diesel consumption between Europe and the US. The other products include ethane, LPG and naphtha which are extensively used in petrochemical production. This will be discussed later in more detail. Note that the total demand may exceed the refinery capacity. This is not surprising as condensate and LPG may not be processed in refinery and with be counted as other demand. In addition there might be imports and exports of finished products (US gasoline and Europe middle distillate. Japan and China, naphtha and LPG.)

Table 1: Source: IEA OMR Feb 2011

Refining Processes and Complexity

The refining process for crude oil can be described by 5 basic process steps as in Fig. 3 below. All modern refineries producing transport fuels will contain these 5 process steps, though not necessarily all of the units described in each process.

Fig. 3 - the 5 refining process steps in a modern refinery.

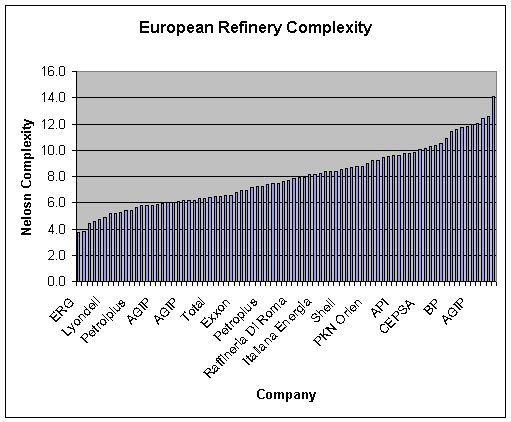

Europe has something of the order of 120 refineries but some of these are very small specialist operations. In the main there are about 79 decent sized refineries with a crude throughput of 13.8 million b/d. One measure of a refinery complexity is the Nelson Index, which assesses the refinery conversion capacity by relating each processing unit capacity against the crude distillation capacity and applying weighting factor. Table 2 gives a simplified list of complexities for individual units and the base line capacities from which they were derived.

Refinery Nelson Complexity = Sum of (Unit capacity/ CDU capacity x Nelson Factor) for all units on refinery.

Table 2: Nelson Refinery Capacity method. From OGJ Dec 20 1999

In the above example, the unit Nelson Factors have been calculated from the baseline unit size. In the above example the refinery total is for illustrative purposes only. I have left out all the possible units for simplicity-i.e no hydrotreaters, oxygenates, isomerisation all of which carry a Nelson Factor.

For Europe, my computer model gave the following distribution in Fig. 4 (note this is the result for individual refineries). Many refiners report the Nelson complexity in their publications, particularly if they have a high score.

Fig. 4 - Source: own model analysis Aug 10

A Nelson complexity of 4 is a simple refinery whilst the refinery of complexity 14 would be regarded as amongst the best in the world, but extreme care should be exercised before concluding that complex refineries are naturally more profitable. In general that is true but very much depends on the product mix. A complex refinery making 40% gasoline at the expense of middle distillate in Europe would be a big mistake. The refinery model I developed is able to calculate a refining margin based on the refinery configuration and product mix, and makes a good estimation of the energy demand and CO2 emissions. This allows a better estimation of refining margin for a particular refinery and allows some modelling with different crude types. (This is not a sales plug - it is not for sale or hire.)

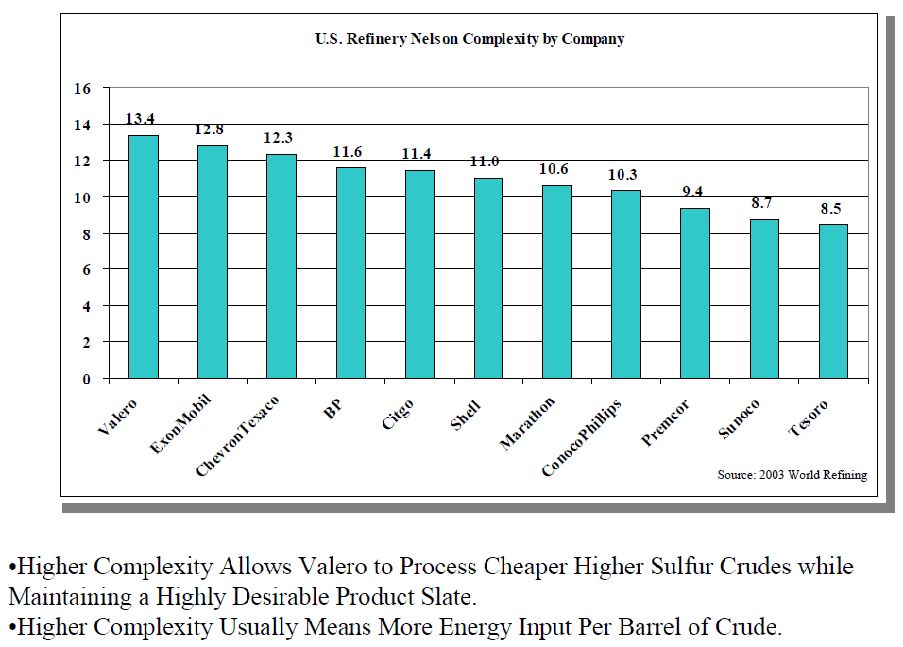

For the US, the situation is as follows (Fig. 5), noting that this is 2003 time-line (still reasonably accurate) and this is the aggregate score for all refineries operated by the owner. In general the US refining base is more complex than the European base:

Fig. 5 - Source: Valero - Refining Complexity 2003

A complex refinery might look like this (Fig. 6) (The actual Refinery is the Chevron El Segundo taken from the Chevron Diesel Fuels Technical Review.) - http://www.buschtaxi.org/downloadz/technik/diesel.pdf or here for later versionwww.chevron.com/products/prodserv/fuels/.../Diesel_Fuel_Tech_Review.pdf

Fig 6 - A complex fuel refinery (Chevron El Segundo)

In this refinery there is high conversion of the the crude to transport fuels with the aim to produce minimum fuel oil. Note that AGO is used to feed the hydrocracker and the FCC, which is not normal for Europe where middle distillates are in short supply. In the US gasoline is the desired product and therefore the AGO fraction is often cracked. Another point to note on this refinery is the use of both a hydrocracker and a FCCU. This is unusual as normally either a hydrocracker or a FCCU is used alone. The light cycle oil from the FCC is a diesel stream with very poor qualities, and is becoming increasingly difficult to blend into road diesel due to the high aromatic and sulphur content. This refinery has a Nelson Index of 10 calculated from the latest OGJ survey. As can be seen there are four main fuel products - gasoline, jet, diesel and fuel oil. In addition there will be coke, sulphur and lpg.

Fig. 7 - A complex Integrated Refinery with Fuels and Petrochemicals - BPRP Gelsenkirchen

BPRP Geslenkirchen's refinery in Fig. 7 is an unusual refinery configuration for Europe and is one of a kind. I have chosen this refinery as it compares well with the Chevron El Segundo refinery in Fig. 6. Both have a Hydrocracker, FCCU and Coker. Gelsenckirchen goes further in that it also has a Visbreaker which is a mild thermal cracking process. You will also see that the coke is calcined which removes the remaining traces of hydrocarbons and produces nearly pure coke. This refinery uses the light distillates for petrochemicals and as a result there is no alkylation unit. The light naphtha and lpg is sent to a steam cracker for olefines production. Some gasoline is produced from the FCC and the reformer. The reformer also feeds the aromatics unit which is used for benzene and xylenes production. Another feature of this refinery is the partial oxidation of the vis breaker tar stream which is used for the production of ammonia and methanol. The Nelson complexity of this refinery is only 8.6 which indicates that this index should be considered very carefully when making comparisons. The production of high value petrochemicals is not reflected in the Nelson analysis. Olefines production is mentioned in more detail later, but note that the BPRP FCC produces propylene which is used for cumene production (propylene + benzene). Note CHD is catalytic hydrodesulphurisation.

The Strangland diagram in Fig. 8 illustrates the hydrogen content vs. molecular weight for various fuel types. As the molecular weight rises the retention of hydrogen in the molecules becomes more important. Cracking reactions tend to reduce the hydrogen to carbon ratio and to maintain the correct H:C ration in the finished product (either hydrogen has to be added or carbon removed). Motor gasoline is more tolerant of lower hydrogen to carbon ratios. Aromatic molecules such as toluene and xylene have H:C rations of just over 1:1. These species have high autoignition temperatures, high octane numbers and good combustion properties in spark ignition engines. Jet fuel and diesel require hydrogen to carbon ratios of close to 2:1. Carbon rejection and hydrogen addition processes are discussed later. Products lying outside of the envelopes will either need upgrading in some form to meet sales specifications. In some cases the cost of the upgrading may be higher than the value of the product. The only option for the peri-condensed aromatics is fuel oil or coking.

Fig. 8 - Strangland Diagram of hydrogen to carbon distribution. From the Encyclopedia of Hydrocarbons

Refinery Crack Spread- refining margins

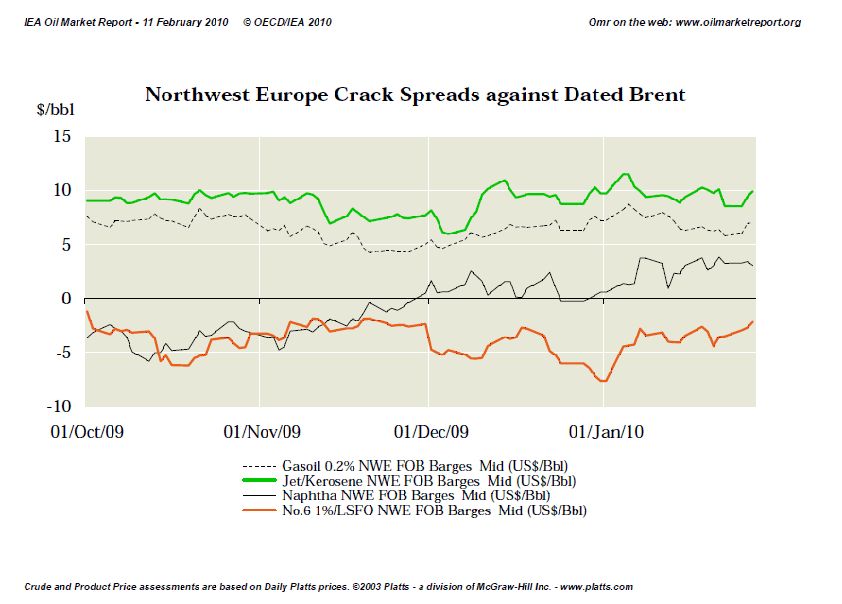

One of the key parameters for a refinery profitability is the crack spread. A selection of crack spreads for different refining centres can be found on the IEA web-site.

Fig. 9 - Crude crack spread for Brent in North West Europe Feb 2011

The crack spread is the margin over the crude price that refiners make. In this example for northwest Europe, the margin on jet kerosene is the highest at $5-10 per barrel. Naphtha is from $-5 to +5 per barrel and fuel oil is a consistent loss at around $-10 per barrel. For commercial reasons the gasoline crack spread is not shown on this graph. The gasoline price however can be obtained from this website as a graph of gasoline pricing. (This is due to Platts licence rules). To make a margin the value of the profitable products has to exceed the net loss of value of the loss making products.

Crude Oil Characterisation, Yields and Residue Upgrading

Crude oil (conventional) can be characterised into 4 main types as depicted in Fig 10. Naturally it is not quite that simple as there are medium grades that lie in between and then there is the ultra heavy which is outside the scope of this essay.

Fig. 10 - Graphic representation of crude oil types

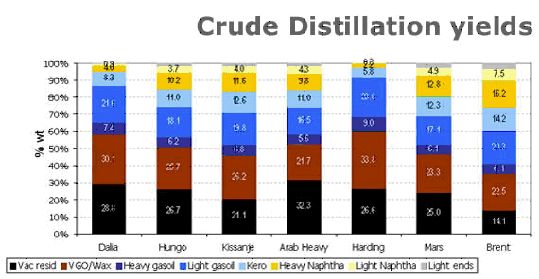

The yield pattern of the crude is important (see Fig. 11). Here is an example from BP (sorry, a bad name in the US).

Fig. 11 - Source BP website

Different crude types have different product yields. The difference between a sweet light crude - Brent and a sour heavy crude - Arab Heavy is dramatic. The main difference between these two types is in the yield of light products and the yield of vacuum residue. The Arab Heavy produces 3 x the mass of vacuum residue compared to Brent. For this reason Brent is seen as a premium crude and Arab Heavy will be sold at a discount to reflect the poorer yield and the higher cost of upgrading.

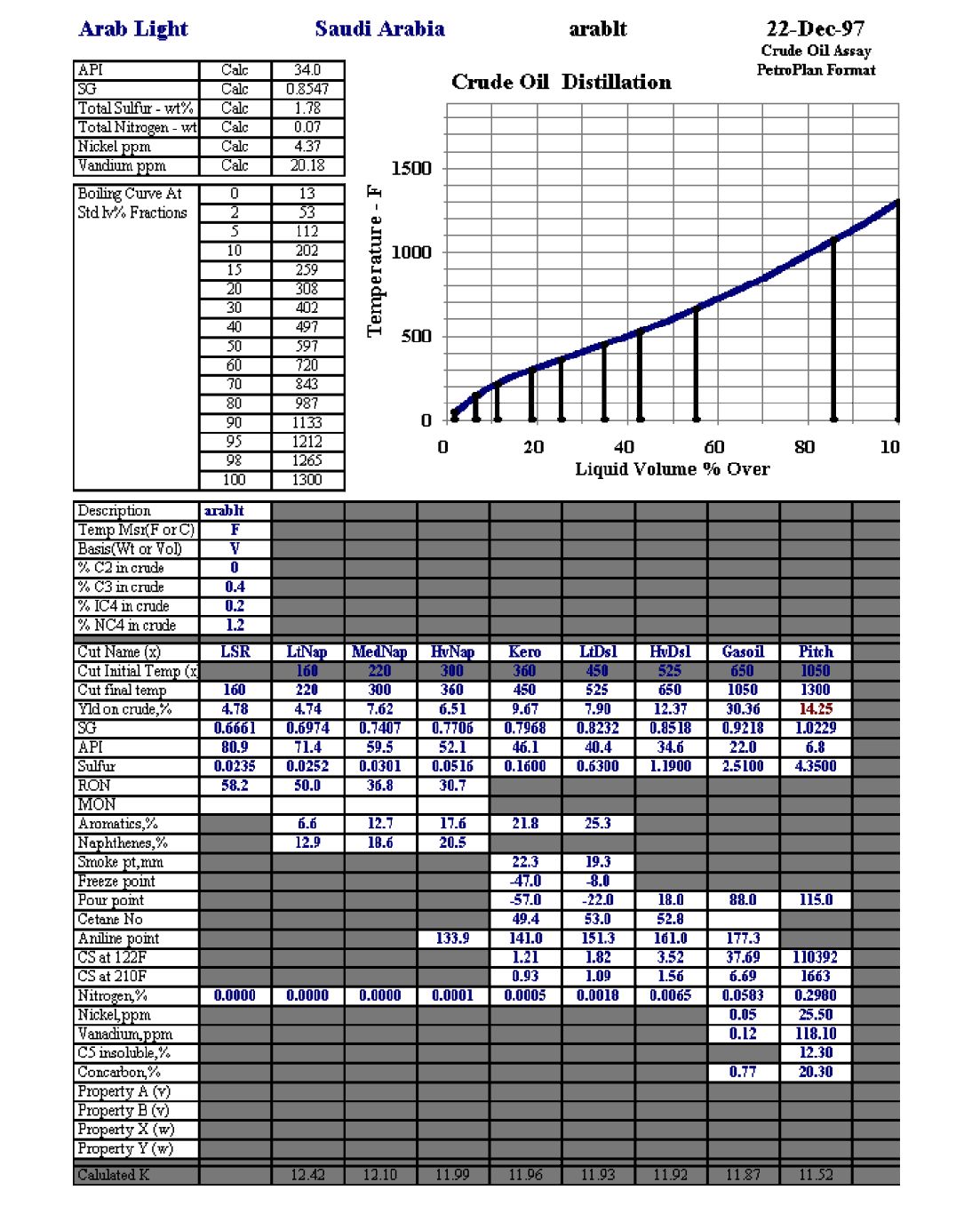

The yield pattern can also be found in the assay of the crude. The example in Fig. 12 is the assay for Arab Heavy, which is a Saudi crude. A source of assays can be found here.

Fig. 12 - Source Petroplan various available from here

There are several important properties worth considering in this essay. The aromatic content of the streams is important for the quality of certain types of fuel. In the middle distillate fractions this is towards the higher end of what would be desirable. Both jet kerosene and diesel properties are influenced by the aromatic content. In the vacuum gas oil and residue, the metals content is important along with the Calculated K (Watson K factor) and the C5 insolubles and Concarbon. The latter is a coke precursor and very much influences how these fractions can be upgraded. You will note how the sulphur concentrates in the heavy fractions, usually in quite complex ring structures which makes removal challenging. In all, this is moderately difficult crude to process. It is the sulphur which is the main issue. For those so inclined you might like to make comparisons with the other crude assays to see the difference. The sharp eyed among you might notice a difference between the BP and Petroplan yields. This is due to BP reporting Weight % and Petroplan Volume %. The Petroplan assay lists 3 naphtha fractions. Not all refineries will split the naphtha fraction in to 3. What I wish to draw to your attention is the RON (Research Octane Number) of the naphtha fractions. These are exceedingly low and would be very difficult to blend into the gasoline pool without upgrading either in a reformer or isomeriser. The kerosene and light distillate and heavy distillate fractions (middle distillates) have good cetane numbers (50 ish) which would be suitable for direct blending into the diesel pool. The pitch or vacuum residue has a high SG of greater than 1 which means it will sink rather than float in water.

Upgrading the vacuum residue

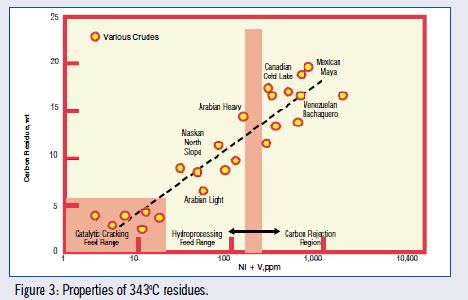

As noted from the simple BP yield data in Fig. 11 we can see a large difference between Brent and Arab Heavy. Processing Arab Heavy will produce 32% of Vacuum Residue, which really only has a use as fuel oil, unless it is upgraded. Several options are available. Coking is the most likely although the quality of the coke produced would not be too good and essentially fuel quality. Hydroprocessing would be costly in terms of hydrogen and catalyst. Below in Fig. 13 is a graphic representation from Foster Wheeler who produce Delayed Cokers. The carbon rejection range refers to coking, although strictly speaking an FCC is a carbon rejection process. Using Arab Heavy as an example processing of residue in a FCC would not be a good idea, as it fails on both metals and carbon residue. Using a Hydrocracker, though not impossible, would entail a large consumption of hydrogen and a shortened catalyst like due to the metals. There are some other possibilities but these are not very common, such as deasphalting followed by hydrocracking of the de-asphalted oil.

Fig. 13 - Source Foster Wheeler: Zero Fuel Oil

Refinery Capacities and the influence of Ethylene Production

It is now worth looking at Regional refining capacity for 2010.

The current US refining capacity is about 17.8 million b/d, and as earlier stated Europe has a refinery capacity of about 13.8 million barrels per day. The Asian capacity has been split into the relevant nations for clarity. I have not considered the exporting nations in this essay. The main exporting nations are the OPEC countries and these countries have different economic drivers to the consuming nations. Table 3 gives a breakdown of the pertinent refinery capacities in the US, Europe and Asia.

Global Refining Capacity 2010

Table 3: Source. OGJ, P&G, C1 Energy and own research March 2011.

Sorry to mix units. Mb/d is million barrels per day and mta is million tonnes per year. For a refinery 100 kb/d = 5 million tonnes crude oil.

As can be seen in Table 3 the regional capacities show some remarkable differences. The large FCC capacity in the US is for the production of gasoline and should there be a switch to diesel cars, as in Europe, the US would have some serious issues with diesel capacity. Catalytic reforming units are similarly large and are for the production of gasoline. The US also has a high installed capacity of coking units which are used for minimising fuel oil production. For the US VDU capacity is 54 % of the CDU, which again points towards the ability to process heavy oils (care must be exercised with this comparison, especially in China). In Europe the same ratio is 41% which illustrates that Europe processes more medium and light crude and is not targeting high conversion to gasoline - go back to Table 1 to compare the demand differences. Both India and South Korea have a low VDU:CDU ratio.The truly scary fact is the scale of the demand growth for oil in China. If those refining capacity estimates are correct for the next 5-10 years then one has to ask where will all this oil come from, since it amounts to around 1 million b/d each year for the next next 10 years.

One of the major petrochemicals produced form refinery feedstocks is ethylene. If associated gases from oil production are available then these are frequently used as ethylene feedstocks and show up as demand but are not necessarily processed in refineries. In the US about 40% of the ethylene capacity is from refinery naphthas whereas in Europe the figure is closer to 75%. In Japan and South Korea the figure is close to 100% as there are no local sources of ethane or lpg. For several decades North Asia has imported feedstocks for ethylene production as the installed refinery base has not been able to satisfy local demand. China is massively expanding its ethylene capacity along with its refining base, which I have illustrated in the bottom half of Table 4. The Asian refinery capacity is not keeping up with the ethylene capacity growth and in 2010 China became a net importer of naphtha for ethylene production. In Europe much of the light naphtha is used for ethylene production, along with lesser amounts of LPG and ethane from local production. Some refiners have implemented heavy feedstocks such as hydrowax which is produced from hydrocrackers as an alternative feedstock to light naphtha. On a volumetric basis, Europe is sinking excess of 10% of the crude oil into petrochemicals if the other materials are also taken into account. Asian crude oil demand is, if anything, even higher for petrochemicals and in China petrochemical growth is outpacing refinery capacity. What I am trying to illustrate here is that a very substantial part of the crude oil barrel is being used for petrochemicals in Asia, which is being used to produce the plastics for the manufacturing base. On a global basis, plastics growth has been exceeding GDP growth for decades. As China industrialises and more Chinese become car owners, the demand for gasoline and naphtha in China is on a collision course. China will have to import increasing amounts of naphtha or the car drivers are going to have to drive less.

Table 4 illustrates the yield of ethylene from various feedstocks.

Table 4: Ethylene Yield from various hydrocarbon feedstocks - Source Chemistry of Petrochemical Processes 2nd Edition. Matar and Hatch

As can be seen, the yield of ethylene varies according to the feedstock. The co-products of ethylene production are in many cases as important as the ethylene itself. Both propylene and butadiene are important chemical feedstocks that are in short supply. Butadiene is widely used in car tyre production and for the production of nylon polymers. Propylene is used both in polypropylene and for the production of other chemical products such as methacrylates, phenol, and propylene oxide. Other routes to propylene are gaining capacity and a new type of FCC has been developed that is configured for the production of petrochemicals rather than fuels, that can produce 40-50% C3 and C4 fractions. Increasing amounts of petrochemicals are now obtained from refineries.

For those interested, Fig. 14 shows the process flow for a naphtha olefines cracker.

Fig. 14 - Schematic flow of an olefines cracker using a liquid naphtha feedstock

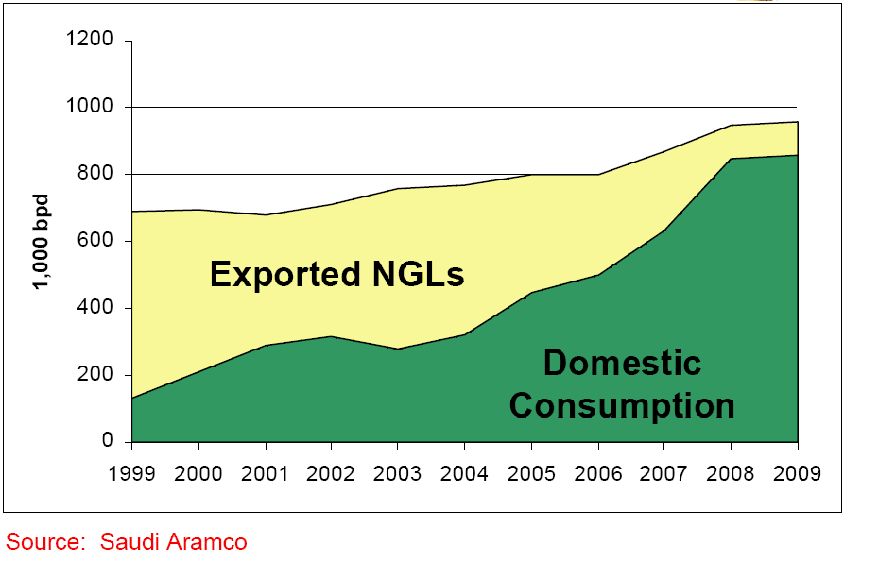

Western refiners are now represented in China, including BP, Exxon, Shell, Saudi Aramco and Kuwait Petroleum. Expect more to follow. In terms of ethylene capacity then use an approximation of 1 million tonnes of ethylene requiring 3.6 million tonnes of naphtha or naphtha equivalent. 5mt of refinery capacity is about 150 kb/d of crude oil. The situation in South Korea, Japan, and Taiwan is such that ethylene capacity exceeds the naphtha production capacity of the country's refineries and these countries have long been net importers of naphtha and lpg for ethylene production. They are about to find that they will be fighting head to head with the Chinese for naphtha supplies, and meanwhile Saudi NGL exports are declining rapidly as they are consumed at home.

From the Saudi Aramco 2009 annual report the production for sale of NGL's amounted to

Propane: 376 kbd

Butanes: 218 kbd

Natural Gasoline: 203 kbd

Gas Condensate: 226 kbd

Fig. 15 - Saudi NGL consumption Source: SRI Consulting Presentation 2009

At the moment, other ME countries exports NGL's including Kuwait, Qatar and the UAE. But plans are afoot for petrochemical plants to locally process these products into value added petrochemicals. The driver behind this is to provide jobs for a rapidly expanding population. Should these NGL's disappear from Asia then the demand for this type of product will have to be met from crude oil, which will mean a substantial increase in crude oil demand in the region, and necessary increases in refining capacity. Meanwhile if the fall in gasoline consumption in Europe continues as predicted, in some forecasts by as much as 30% by 2020, then there is the probability that further closures of European refineries are likely, and that Europe will be looking East and West for jet and diesel to fill the shortfall in production. By 2020 Europe has legislation in place to reduce the average CO2 emissions for new cars to 95 gms per kilometre - a tough target that few cars are capable of to date.

One thing for certain, the next few years are going to be challenging for refining. Many refiners struggle to make money currently as refining margins slide back to $2-5 per barrel. My own refinery model clearly demonstrates this phenomena and finished product prices will have to rise substantially.

NUTSHELL:

This article is rather long but relatively thorough in giving ground breaking insight into refining as a whole. However we are challenged to break the oil barrel into its several components with a view to understanding exactly what it becomes. The thrust of this article is all about where the refineries are, what they do and how they fit into the demand and supply equation for crude oil. Whereabouts are your national refining capabilities?

No comments:

Post a Comment