By Marcia Ashong

The inevitable consequence of scarce energy resources in recent years has resulted in a 21st century rat-race, signified by intense competition and an insatiable appetite for all things energy – energy needed to power the growth of the globalized industries as well as support the developmental efforts of emerging economies. In the oil and gas industry this quest has led to growing developments in unconventional methods of natural resource extraction which is easily demonstrated by the depths to which global oil and gas producers are drilling to source the needed commodities; the Brazilian, Gulf of Mexico and Gulf of Guinea deep offshore discoveries only serve to illustrate this point.

The inevitable consequence of scarce energy resources in recent years has resulted in a 21st century rat-race, signified by intense competition and an insatiable appetite for all things energy – energy needed to power the growth of the globalized industries as well as support the developmental efforts of emerging economies. In the oil and gas industry this quest has led to growing developments in unconventional methods of natural resource extraction which is easily demonstrated by the depths to which global oil and gas producers are drilling to source the needed commodities; the Brazilian, Gulf of Mexico and Gulf of Guinea deep offshore discoveries only serve to illustrate this point.At the backdrop of this development is the story of Ghana whose 2007 Jubilee petroleum discovery promulgated the West African nation into the exclusive global oil producers club. The 60 km offshore Gulf of Guinea discovery of 600 million barrels of oil with an upside potential of 1.8 million barrels was expedited through its appraisal and development phases to break records, as it commenced production merely three years after discovery. Since then a host of discoveries culminating with crude oil deposits as well as vast natural gas potential uncovered a further 65 km off the coast of Ghana have rallied interest in the region, and will undoubtedly earn the country its place among the top producers in Africa.

It has been approximately seven months since the Jubilee field commenced production slowly easing its way from a modest 20,000 barrels per day (bpd) to just a few months ago ranging between 80,000 to 120,000 bpd. In comparison to global producers like its neighbour two doors to the East (Nigeria), the production rates are nominal to say the very least, and the petroleum revenues as they currently stand do not pretend to be a panacea for poverty eradication. But for Ghana the added revenue source poses opportunities that hitherto have been barely afforded to the country. Analysts estimate that the true benefits will not be realized until much later however, the reality remains that while oil just began flowing in December, the country has seen significant changes, some of which are tangible benefits that seem to be directly resulting from the associated petroleum discoveries.

Direct Economic Impact

A 2009 World Bank publication dubbed “Economy-wide Impact of Oil in Ghana” closely estimated the perceived benefits Ghana was likely to encounter resulting from a sudden introduction of oil and gas revenues. The potential for increased public expenditure from oil revenues according to the report was to become a unique opportunity towards enhancing the country’s competitive advantage, so far this statement rings true. A Q4 2010 economist publication also indicated that the country’s growth was set to reach double digits as oil streamed in significant quantities. It is sufficient therefore to assume that Q1 results proved this to be accurate as Ghana’s economic growth accelerated to an annual 23% percent, the obvious effect being the increased public revenue clearly evidenced by the supplementary budget. According to Mohammed Amin Adam, a petroleum economist, “in addition to oil revenues, the oil and gas sector will contribute more to the estimated growth for the year as captured in the Supplementary Budget with oil induced growth rate put at 14.4% against a non-oil growth of 7.5%, this can be mainly attributed to both export growth and upstream investments,” he said.

A 2009 World Bank publication dubbed “Economy-wide Impact of Oil in Ghana” closely estimated the perceived benefits Ghana was likely to encounter resulting from a sudden introduction of oil and gas revenues. The potential for increased public expenditure from oil revenues according to the report was to become a unique opportunity towards enhancing the country’s competitive advantage, so far this statement rings true. A Q4 2010 economist publication also indicated that the country’s growth was set to reach double digits as oil streamed in significant quantities. It is sufficient therefore to assume that Q1 results proved this to be accurate as Ghana’s economic growth accelerated to an annual 23% percent, the obvious effect being the increased public revenue clearly evidenced by the supplementary budget. According to Mohammed Amin Adam, a petroleum economist, “in addition to oil revenues, the oil and gas sector will contribute more to the estimated growth for the year as captured in the Supplementary Budget with oil induced growth rate put at 14.4% against a non-oil growth of 7.5%, this can be mainly attributed to both export growth and upstream investments,” he said.

Furthermore, according to a statement from a top official of the Ghana National Petroleum Corporation (GNPC), greater international investor interest not just in oil and gas but in all sectors are to be realized. Official government data as of Q1 indicated that the industrial sector’s growth was to benefit at most 21% compared with the previous year and this growth has been largely attributed to petroleum production. It is therefore the case in Adams’ view that the oil sector will continue to boost the economy both in revenue terms and in the growth of the productive sectors, especially with increased production and with rising crude oil prices. Adams however cautioned that the quality and efficiency of the investments of oil revenues is a key determinant of the growth prospects in the economy.

Socio-economic Developments

Oil and gas production efforts have also seen a surge in service companies and local sub-contracting entities springing up in Ghana every so often, all with the aim of providing the essential link between international corporations with years of expertise, and local knowledge to bridge the obvious gap in on-ground expertise. These new entities, mainly international oil and gas service players like Halliburton, Baker Hughes, Schlumberger and National OilWell Varco have together contributed a significant amount to foreign direct investment efforts with enhanced opportunities for local involvement. Their presence will undoubtedly add value to the local environment. Airport City for instance, conveniently contiguous to, and less than a mile away from the country’s main airport in the capital Accra, has asserted itself as the administrative hub for international energy entities. And Takoradi, the once sleepy port approximately 185 km from the capital and the largest city nearest to the oil fields, provides a convenient site for oil and gas transportation facilities, storage equipment, and the essential technical service workers. So far these two distinct roles have incidentally decentralized the benefits from petroleum activities by ensuring a wider section of the population can access the ancillary benefits.

Oil and gas production efforts have also seen a surge in service companies and local sub-contracting entities springing up in Ghana every so often, all with the aim of providing the essential link between international corporations with years of expertise, and local knowledge to bridge the obvious gap in on-ground expertise. These new entities, mainly international oil and gas service players like Halliburton, Baker Hughes, Schlumberger and National OilWell Varco have together contributed a significant amount to foreign direct investment efforts with enhanced opportunities for local involvement. Their presence will undoubtedly add value to the local environment. Airport City for instance, conveniently contiguous to, and less than a mile away from the country’s main airport in the capital Accra, has asserted itself as the administrative hub for international energy entities. And Takoradi, the once sleepy port approximately 185 km from the capital and the largest city nearest to the oil fields, provides a convenient site for oil and gas transportation facilities, storage equipment, and the essential technical service workers. So far these two distinct roles have incidentally decentralized the benefits from petroleum activities by ensuring a wider section of the population can access the ancillary benefits.

Moreover unlike the 10% revenues to communities closest to the oil-bearing region which was initially proposed as an amendment to the early ‘Petroleum Revenue Management Bill,’ the Jubilee Partners have instead decided to take the ‘bull by the horns’ so to speak, by recently announcing an initiative to use their collective resources, and pledged a $1.6 million facility in efforts to develop six coastal districts of the Western Region. The scheme is part of a region-wide town planning initiative instituted to mitigate the adverse effects of industry growth, signified by uncontrolled development, the essential goal being the simultaneous growth of industry along-side the “re-engineering of infrastructural, social, economic and cultural dynamics.” In spite of the delay of several enabling legal structures that would ultimately address various issues from licensing, environmental regulations to local content development, it seems in part that certain efforts are already being made especially within the realm of local content development in the quest to immediately address the expertise disparity.While there is a clear shortage in high-level local technical capabilities the need for low-level technical assistance for instance, has enabled the creation of thousands of work opportunities for young residents especially within the Takoradi region, a development which has instantly realized a surge in new workers, bringing a sharp decline to local unemployment rates.

Moreover unlike the 10% revenues to communities closest to the oil-bearing region which was initially proposed as an amendment to the early ‘Petroleum Revenue Management Bill,’ the Jubilee Partners have instead decided to take the ‘bull by the horns’ so to speak, by recently announcing an initiative to use their collective resources, and pledged a $1.6 million facility in efforts to develop six coastal districts of the Western Region. The scheme is part of a region-wide town planning initiative instituted to mitigate the adverse effects of industry growth, signified by uncontrolled development, the essential goal being the simultaneous growth of industry along-side the “re-engineering of infrastructural, social, economic and cultural dynamics.” In spite of the delay of several enabling legal structures that would ultimately address various issues from licensing, environmental regulations to local content development, it seems in part that certain efforts are already being made especially within the realm of local content development in the quest to immediately address the expertise disparity.While there is a clear shortage in high-level local technical capabilities the need for low-level technical assistance for instance, has enabled the creation of thousands of work opportunities for young residents especially within the Takoradi region, a development which has instantly realized a surge in new workers, bringing a sharp decline to local unemployment rates.

Local employment efforts are also a strong focus for civil society organizations who early in the game occupied the role as quasi industry watch-dogs. The Civil Society Platform for instance, under whose leadership close to 124 civil society organizations came together to compile the ‘Ghana Oil Readiness Report Card,’ have used such tools to actively engage industry participants to take stock of their achievements in ensuring the sustainable development of petroleum activities. Among the achievements recorded is the fact that Tullow Oil, under whose operatorship the country spearheaded its first oil and gas production, recently exceeded over 70% local employment requirements.

Economic and developmental efforts are also underpinned by the long-term commitment of oil and gas industry players and recently Tullow, once again sealed its name in the books by allotting over 3.5 million shares to be offered in the secondary listing of the Ghana Stock Exchange. According to a Tullow official, the decision by the company resulted in the largest ever primary share offer completed in Ghana. With the discourse of local content development top on the national agenda such efforts according to industry experts is a clear illustration of the various forms through which local content development may

be achieved.

Institutional Capacity

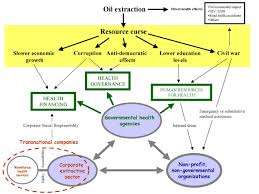

At the outset Ghana has been on the quest to avoid what many dub the “Resource Curse” which is typified by a country rich in natural resource wealth yet unable to supply basic needs to its populace. In the effort to avoid this resource paradox a host of donor assistance programs have emerged to ensure the West African nation carves a distinctive path from its neighbors. An essential support mechanism has been to enhance the capacity of public bodies in their efforts as the main regulators of the industry. The Ministry of Finance for instance was recently involved in a series of taxation courses with the support of international consultants and experts as it embarks on its newest role in oil revenue management. In 2010 the World Bank announced a concessionary facility of $38 million to the government in aid of its capacity building efforts. Among other donors include the Norwegian government which has also pledged a $5 million grant. The Environmental Protection Agency (EPA), with both governmental and international donor support has been actively engaged in revamping its operations towards equipping the entity to handle the resulting environmental consequences of petroleum extraction.

At the outset Ghana has been on the quest to avoid what many dub the “Resource Curse” which is typified by a country rich in natural resource wealth yet unable to supply basic needs to its populace. In the effort to avoid this resource paradox a host of donor assistance programs have emerged to ensure the West African nation carves a distinctive path from its neighbors. An essential support mechanism has been to enhance the capacity of public bodies in their efforts as the main regulators of the industry. The Ministry of Finance for instance was recently involved in a series of taxation courses with the support of international consultants and experts as it embarks on its newest role in oil revenue management. In 2010 the World Bank announced a concessionary facility of $38 million to the government in aid of its capacity building efforts. Among other donors include the Norwegian government which has also pledged a $5 million grant. The Environmental Protection Agency (EPA), with both governmental and international donor support has been actively engaged in revamping its operations towards equipping the entity to handle the resulting environmental consequences of petroleum extraction.

Conclusion

With all these achievements in line, Ghana, post-oil production is seemingly on a path to steer away from the resource curse. Yet even with all the timely benefits it is still premature to predict where the future lies for this new oil producer. The reason is simple, the petroleum world is rarely a predictable one and for a country like Ghana, which still remains a nation with immense developmental challenges, infrastructure deficiencies and inefficient access to energy, progress it seems must be measured cautiously.

At the outset some opportunities were clearly missed. An early benefit for instance should have been the simultaneous development of natural gas infrastructure and delivery paving perhaps a way to wean the country off high dependence on costly fuel for power production. But this opportunity was lost, a reflection of the inadequate policy and planning towards integration of oil and gas into long term socioeconomic development for public benefit. Enabling public legislation aimed at addressing the very basics of a 21st century petroleum industry are still yet to be achieved, the stall has various implications, a major one being the current regulatory lull that the industry faces, such a void if not instantly addressed can easily affect investor confidence, while more acutely paving way for an industry less conscious of regulatory mishaps. But yet still there is hope, hope because as all eyes are on Ghana to set yet another African record, the added pressure it seems has necessarily placed all stakeholders on high alert and for the near future it is much easier to predict that indeed the country is on the path

to a “non-resource curse.”

NUTSHELL:

This is a wonderful article- by Marcia Ashong- which has just been published in the August issue of the Petroleum Africa magazine. I find this appraisal of Ghana's efforts on its Oil and Gas sector as timely, especially as the Chairman, Parliamentary Sub-Committee on Energy-Ghana (Hon. Moses Asaga) attended a lunch meeting with members of The Petroleum Club in Lagos. In this meeting Hon. Asaga outlined the lessons that Ghana has learned in its experience thus far- on capital gains tax, the status of Tullow, Cosmos, ExxonMobil and China in the Oil and Gas Industry, where not to learn how to manage mineral resources revenues (he probably implied Nigeria), where to learn how to manage mineral resources revenues (he implied the likes of Norway); he also talked about the Ghanaian Senate being the ultimate approving authority with respect to Oil and Gas agreements in Ghana and expressed the need to learn from the likes of Nigeria on how the administrative aspect of the industry actually does work. These all tie into the message that Marcia brings in her analysis; there has to be a direct economic impact of the benefit derived from Oil and Gas earnings; this naturally translates to an examination of the current socio-economic developments which logically leads us to appraise the institutional capacity of the nation. Hon. Asaga's sharing experience has indeed opened my eyes up to see that Ghana means business about its Oil and Gas Industry; Marcia gives us an insight into how much has been done and how much more there still is to be done- from her insightful perspective. Let other Oil and Gas producers within Africa take a leaf from one of Africa's proud sons- Ghana. For more information on this article and to view Marcia's professional profile, click here.-->

This is a wonderful article- by Marcia Ashong- which has just been published in the August issue of the Petroleum Africa magazine. I find this appraisal of Ghana's efforts on its Oil and Gas sector as timely, especially as the Chairman, Parliamentary Sub-Committee on Energy-Ghana (Hon. Moses Asaga) attended a lunch meeting with members of The Petroleum Club in Lagos. In this meeting Hon. Asaga outlined the lessons that Ghana has learned in its experience thus far- on capital gains tax, the status of Tullow, Cosmos, ExxonMobil and China in the Oil and Gas Industry, where not to learn how to manage mineral resources revenues (he probably implied Nigeria), where to learn how to manage mineral resources revenues (he implied the likes of Norway); he also talked about the Ghanaian Senate being the ultimate approving authority with respect to Oil and Gas agreements in Ghana and expressed the need to learn from the likes of Nigeria on how the administrative aspect of the industry actually does work. These all tie into the message that Marcia brings in her analysis; there has to be a direct economic impact of the benefit derived from Oil and Gas earnings; this naturally translates to an examination of the current socio-economic developments which logically leads us to appraise the institutional capacity of the nation. Hon. Asaga's sharing experience has indeed opened my eyes up to see that Ghana means business about its Oil and Gas Industry; Marcia gives us an insight into how much has been done and how much more there still is to be done- from her insightful perspective. Let other Oil and Gas producers within Africa take a leaf from one of Africa's proud sons- Ghana. For more information on this article and to view Marcia's professional profile, click here.-->

The inevitable consequence of scarce energy resources in recent years has resulted in a 21st century rat-race, signified by intense competition and an insatiable appetite for all things energy – energy needed to power the growth of the globalized industries as well as support the developmental efforts of emerging economies. In the oil and gas industry this quest has led to growing developments in unconventional methods of natural resource extraction which is easily demonstrated by the depths to which global oil and gas producers are drilling to source the needed commodities; the Brazilian, Gulf of Mexico and Gulf of Guinea deep offshore discoveries only serve to illustrate this point.

The inevitable consequence of scarce energy resources in recent years has resulted in a 21st century rat-race, signified by intense competition and an insatiable appetite for all things energy – energy needed to power the growth of the globalized industries as well as support the developmental efforts of emerging economies. In the oil and gas industry this quest has led to growing developments in unconventional methods of natural resource extraction which is easily demonstrated by the depths to which global oil and gas producers are drilling to source the needed commodities; the Brazilian, Gulf of Mexico and Gulf of Guinea deep offshore discoveries only serve to illustrate this point.

Good post! Associate Tax and Legal advisors in Ghana. Associate Tax and Legal advisors in Ghana

ReplyDelete